Ogilvy Africa and Ogilvy Social Lab held a session in Nairobi a few days ago. Speakers tackled the state of social media in 2019 in terms of technology usage, making brands stand out, and the role of influencers, among other items.

It looked at trends in the world of media dominated by platforms like Facebook, Twitter, Amazon, Google (the four horsemen of the internet), and we learnt that we are in the middle of the biggest social experiment ever as billions across the globe use these platforms every day to network, communicate, transact, engage and get information.

Some of the highlights included:

- People look at their mobile phone screens an average of 53 times a day – consuming information as text, images, video, and stories in bit sizes.

- Users spend an average of 6 hours 45 minutes per day consuming digital media, with social media accounting for 2 hours and 20 minutes of that. In Kenya, one study found that young users spend 3 and ½ hours a day on social media.

- Kenya has 8 million Facebook users and 700,000 Twitter users. It also has 1.5 million on Instagram and 2.1 million on LinkedIn.

- But engagement is a poor predictor of business results. Brands should produce less content, personalize it and pay to promote it.

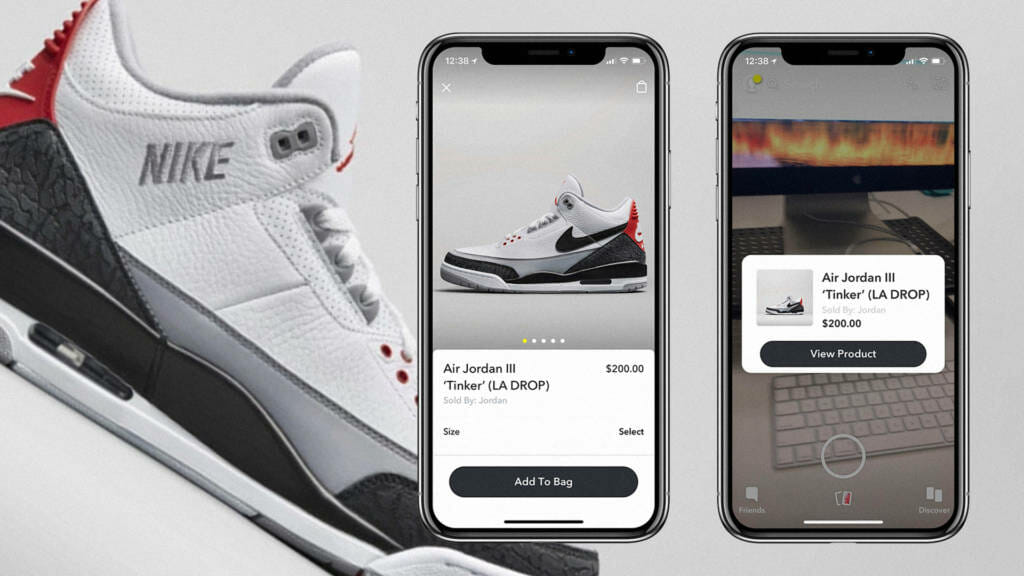

- Everything is becoming a shop – thanks to tools like augmented reality, ordinary objects like posters and benches can come to life when viewed through a phone lens – and lead to hidden videos and links to merchants as seen in Snapchat Lens, Google Lens and Shopping on Instagram. An example was cited of the Jordan shoe sale marking the 30th anniversary of Michael Jordan’s iconic dunk – people at special Nike parties who watched a geo-located augmented-reality advert on Snapchat were able to order a new release of the vintage shoes, in their size, and have them delivered to their homes in two hours. The shoes sold out in a few minutes.

- People go to YouTube with ‘intent’ – they know what they are looking for and want to watch (usually in the evenings) and this contrasts with ‘discovery’ driven video consumption in the daytime. Also, the first seconds matter the most – there is 47% awareness created in the first three seconds of a video message.

- The most ignored influencer is the one who works in customer care.