I am a Blackberry (BB) user. It’s been a struggle to keep up with the world as not many new apps are being created or updated for Blackberry. While the number of BB users has flat-lined, many remain loyal and tied to their devices.

They also appreciate the platform and new apps that improve the phone experience. The app world today is considered to be either Android (Google) or iPhone (apple) – and developers and institutions are primarily making apps in these two formats only. So it’s nice to see a few banks still coming up working apps for with Blackberry, and the BB10 (platform). Here are a few:

Chase Bank (Mfukoni): Chase customers always rave about Mfukoni online. But starting the BB10 app starts with a somewhat sinister request for loads of data, even to open and run the app. This includes a request to connect with, and invite other BBM users, location data, shared files, calendar contacts, camera, SMS, email & PIN messages etc. If you decline, you can’t do things like search for branches or ATM’s without enabling location settings. Once connected, It seems you can open accounts, view products (youth current, women accounts, etc), request insurance, and ATM cards. But it has a few dead menus too.

Chase Bank (Mfukoni): Chase customers always rave about Mfukoni online. But starting the BB10 app starts with a somewhat sinister request for loads of data, even to open and run the app. This includes a request to connect with, and invite other BBM users, location data, shared files, calendar contacts, camera, SMS, email & PIN messages etc. If you decline, you can’t do things like search for branches or ATM’s without enabling location settings. Once connected, It seems you can open accounts, view products (youth current, women accounts, etc), request insurance, and ATM cards. But it has a few dead menus too.

Co-Op (MCo-Op Cash): From the start, you can log in or do self-registration. You really can’t browse the products, or see how rich the app experience is for customers until you first register. But this is an easy process, that does not require much information – just your name, telephone number, national ID number, birth date, and your existing account number (if you’re already a Co-op customer).

Family Bank (Pesapap): The app also starts with a request for lots of information like the Mfukoni one. So, once again, it wants to access your camera, device information, location data, microphone, text, email & PIN messages, calendar, and contacts. Later, you can log-in, request for cards, get locations of branches & ATM’s, but while it only took a few MB to install, it sometimes kicks you out, with a warning that your phone needs more memory.

Sidian (Vibe): It’s nimble, light, and not intrusive, with good navigation and responses. It has a menu that you can jump back to, sending you back to the main menu if you cancel (e.g if you’re checking out a service that requires you to be registered / or you don’t have an account).

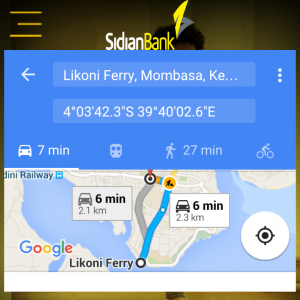

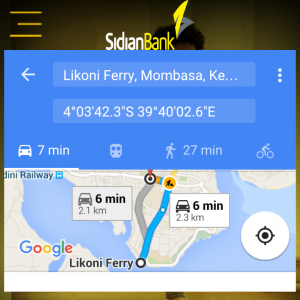

Self-registration and signing in is simple and you only have to enter your user name (usually your mobile phone number) and a PIN. Even from the outside, you get to see a lot of what account holders can do – merchants, ticket sasa, you can search for branches and ATM’s , and they show up on a map, after which you can enter a starting point (in lieu of it pulling your phone location data) and it will give you driving directions, and even traffic information enroute, (Google has activated for Nairobi). It has the crucial m-pesa link (bank account to m-pesa, and m-pesa to bank account) and if you click to contact the bank, one click starts a call to the bank or creates an email message to the bank.

Bank of Africa (BMobile): Also asks for the voluminous info as some of the other apps, but you can bypass that request. Once you get to the products, the navigation is not very good as the menus are limited, but if you get stuck there’s a home button which takes you right back to the start. It also has a few dead menus like the debit and credit card types.