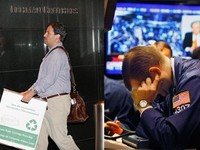

With Lehman, AIG, Bear Stearns, Merrill Lynch and other banks in the news, or in need of a rescue, it’s time to look how does this play out locally?

Kenya has experienced several collapses over the last few years – from listed companies (Uchumi supermarket), stockbrokers (Nyaga, Francis Thuo), insurance companies (Invesco), medical plans (Mediplus), Banks (Euro, Daima, Charterhouse), and numerous pyramid schemes.

What are the stages of collapse?

Before: First come the rumours, which can be whispers from clients facing frustrations, or sometimes well-meaning staff leak to their trusted clients that something is amiss. At any given time, a company could face this and currently, there are murmurs about a stockbroker, a transport company, and an insurance company – but none about banks.

During: Next the rumours gather steam and reach serious partners who deny the company access to cash that it needs to survive. The struggling company will by this time have stopped paying on time and will be known for inventing excuses for delays in payment. So suppliers will stop deliveries (bare shelves), customers withdraw cash and banks will refuse to lend to ailing to the company/bank.

An aside – in the current issue of the Financial Post, entrepreneur Dr. Manu Chandaria talks about the secrets of Asian company success including using supplier credit as the expansion capital – and he emphasizes that a growing company must have a perfect reputation with creditors to get the supplier financing to grow.

But eventually, word leaks out and depositors try and withdraw their cash from the bank or pyramid, a major creditor moves to seize assets, any of which may hasten the collapse of the company; Eventually the government or a bank may try and appoint a receiver, but often its too late.

After: If there is enough hue and cry or a serious precedent likely to have far-reaching effects, the government may step in and try and revive the company – the government has capitulated to the cries of shareholders, suppliers, farmers (sugar/coffee etc.) and politicians several times over the years and tried to revive numerous companies that have collapsed.

If it’s a bank, its depositors get paid up to 100,000 shillings ($1,400) from the deposit protection fund, if its an insurance or medical company it’s a total loss for subscribers who will have to source for new cover packages even if the company had enough assets left. The fate of shareholders is still been sorted out at Nyaga and Francis Thuo, while its a total loss for the thousands who ‘invested’ in unregistered pyramid schemes even though millions of shillings of their ‘profits’ remain unclaimed in bank accounts that have been frozen.

Employees of the companies quietly get new jobs and airbrush the unfortunate period from their CV’s

Owners/Principals rarely face prosecutions, and having amassed enough to survive a few years of legal battles, may retire quietly or sometimes end up in parliament.

Locally: So far it appears that the successful AIG Kenya [worth ~$35 million] will be insulated from its parent problems. It will probably be absorbed by another local insurance company or CBA bank who are a major shareholder.

Hi Banks…. I finally have my own blog – check me out once in a while:

http://maishinski.blogspot.com/

If you like, you can add my blog to your blog list.

Am still retaining life membership to your blog though..

🙂

Banks: Am not so sure about AIG Kenya, let’s wait and see, but I would not want to be in there.

It’s a shame we don’t have a company like Goldenberg (lol) on the NSE, gold prices seem to be soaring today.

AIG Kenya is a majority-owned subsidiary of American International Group, Inc. (AIG).

It may be one of the assets that AIG puts up for sale especially if they are unaffected by the current crisis.

Trying to say that there are similarities to the Kenyan situation and the Wall Street situation, nahh..

So what if Lehman hired George Bush’s cousin and brother

http://www.reuters.com/article/fundsFundsNews/idUSN3046902620070830

So what if the state of Florida took a wash, because othe risky derivatives were sneaked into the state funds

http://www.forbes.com/business/2007/11/30/florida-bush-lehman-biz-beltway-cx_mb_1130florida.html

It is just a coincidence 🙂

Btw, Ssembonge what does “majority owned subsidiary” mean? Who is the majority, AIG parent?

The only difference is that in Kenya until recently, you only found out that a firm was in trouble the day you turned and saw the heavy padlocks and agitated crowds. Or in the case of Uchumi and Nyaga, after the owners and other insiders had already taken assets and run for the hills.

AIG in Kenya needs to sell itself off now before it desperately has to.

is Blue Shield on your wall of fame?my claim stands unpaid for over 7 months.

Infact i thot after the suggestion in the last june budget on penalties on claim pay’t delay would thwart them into working hard.

You mentioned a stockbroker rumored to be on the verge of collapse. Is it D&B? I have trouble getting them to even send me my monthly statements. I place orders and it takes so long until I give and wait for the day they decide to execute my orders. I am contemplating exiting from the broker.

The Kenyan markets are to insulated and small to be affected by the meltdown in NY,the situation affecting Lehman bros,AIG, Meryl lynch is mostly as a result of bad investments in secondary mortgage related products, Their level of exposure is higher than previously thought..And this driven further by speculative trading read short traders. the result is a luck of market enthusiasm and general luck of interest in the markets, To its credit the Fed has moved to quell speculation By keeping interest rates unchanged,had authorized a $180 billion expansion of its temporary reciprocal currency arrangements, known as swap lines, to allow banks to borrow more dollars in money markets at a lower rates.I’m bullish and hopeful there will be a turn around,It has happened before, We should treat this as a big Market correction.

Banks:

How did you come to the conclusion that AIG is worth 35 million dollars? just curious.

Phil:

The fed is doing a good job by printing money to bail out these corporate fraudsters? keep drinking that de-regulation kool aid buddy. Yup…drink it all the way to Alan Greenspand doorstep.

Kenyanentrepreneur.com

one thing i got ahand to the americans is the speed with which they deal with this issue – bear stearns is gone,lehmans is history.

we still dealing with coffee board and consolidated bank and national bank 20yrs after the fact

Maishinski: great added you to the roll

Rafiki: it’s amazing how many companies are applying for and getting gold and precious metal licenses in Kenya. Maybe pattni was on to something

Ssembonge: they should, it would be snapped up quickly

MainaT: not quite, ether are enough rumors always, collapses are rarely a surprise in Nairobi

Inspectordanger: doubt its D&B, have not heard anything there – isn’t the most capitalized broker? Maybe just bad customer service

Phil: I believe so too, but there could be some impact from a reduction in Diaspora remittances and investments

Kenyanentrepreneur: ok that’s the size of the AIG Kenya insurance business, not fund

To my mind, creditors do not make sufficient use of debt collectors. Collection House is one of the most efficient at an economic rate. http://collectionhouse.blogspot.com

My broker is going to go down. If you invest with them like I do, your shares and mines are like trays of eggs in a car about to have an accident. I want to know if its possible to change a broker. Banks advice on this. The employees are thugging the company. The internal auditor knows it but he too is crooked. Some meet at ABC Place to discuss the progress they are making. They are buying many cars and houses and they mostly pay for this in cash. Something very wrong is going on there. A storm between the thieving partners is also brewing daggers are being drawn things are not very kool there!

Thanks for this insightful piece, when I read about Hon. Michuki insisting that Kenya won’t be affected I had to come and reread this post, and blog about it. LOL

Maybe our leaders should (just once) stop with the endless denial and offer real solutions.

Keep up the good work!