A roundup of recently published economic forecasts, reports, and surveys.

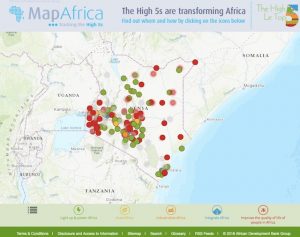

AfDB: The African Development Bank’s interactive platform, #MapAfrica, maps the locations of the bank’s investments in every country across Africa.

Barclays: In Nairobi this week, Barclays Africa launches the 2017/18 macro-economic report as well as the Africa Financial Markets Index, which is a survey of 17 African stock markets.

Citi: Citi Research has just published two reports on frontier markets and one on food inflation in Africa. Citi found that frontier markets did better than developed markets and that Kenya did well (36% return on equities) despite the banking interest cap law and the prolonged election season which has now ended.

Citi’s forecasts of top picks for frontier markets in 2018 are Sri Lanka, Romania, and Kenya and they see weaknesses for Argentina, Morocco, and Egypt. The Citi rankings consider six factors: macro growth, macro imbalances, monetary factors, valuations, earnings momentum and price momentum for their forecasts. Citi also ranked five top stock for frontier markets BGEO Group (Georgia), Humansoft (Kuwait), IDH (Egypt), KCB (Kenya) and MHP (Ukraine). For KCB they like the growth profile of corporate and salaried customers from which the bank will grow market its share even if the banking law remains the same.

The Citi forecasts also looked at the Kenyan currency (shilling) which has remained stable relative to other African currencies and how it will continue to do so even with the country’s balance of payments deficits and heightened politics. But they found that one problem with making Kenya predictions is that a significant portion of inflows that offset the current account deficit is classified as other flows, and their timing is not predictable. They assume that the inflows are from the East and Central Africa region that sees Kenya as a safe haven, despite the politics of the second half of 2017. Another finding was that devaluation of currencies have a bigger impact on food inflation in sub-Saharan Africa but Kenya which had drought and food security issues in 2017 is able to draw on food production from its neighbors (Ethiopia, Tanzania, Uganda) that keeps food inflation in check even though the food trade data is not captured in official statistics.

World Bank: Meanwhile the World Bank is taking heat after one of their economists admitted that the WB “Doing Business” rankings for Chile had been manipulated for political reasons. The Doing Business reports are cited by leaders of several countries such as Kenya, Rwanda, India as indicators of their good performance in office, But this one admission of political interference could trigger fall out as to the credibility of other reports, country economic forecasts, growth statistics, inflation measures and discussions with governments that the World Bank does.

Original article, for those looking for it https://t.co/axsug1wMxb and English language description if no WSJ subscription https://t.co/Eq2mkUyNe7

— jody (@JodyShenn) January 13, 2018

The Oxford Business Group: The Oxford forecasts reviewed the year Kenya in 2017 in which growth was expected to be about 5% (down from an initial forecast of 5.8% for 2017), but still above the sub-Saharan Africa average of 2.7%. It noted the mixed agriculture performance was due to the drought that affected maize, sugar, tea. Also that Kenya’s Supreme Court decision to nullify the presidential election set a good path for the country in 2018 despite the added cost of staging two elections in 2017 affecting the government’s ability to meet budgetary targets and which later resulted in Moody’s considering a downgrade of Kenya’s debt rating.

Brookings: The Brookings forecasts are contained in Foresight Africa, an Africa-focused report that celebrates Africa’s growth and highlights priorities for the continent. For Kenya, it contains a sum up of the ability of the country to leverage technology and innovation for things like revenue collection and uptake of products and mobile bonds (M-Akiba), M-Tiba, and IFMIS. It mentions that Kenya can balance the impact of special economic zones and infrastructure from China against politics and that the successful launch of the SGR in May 2017 could one day serve Uganda Rwanda, Burundi and even Tanzania South Sudan and Ethiopia. It has special sections on the 2017 Kenya election and the M-Akiba bond (“The KSh 150.04 million (approximately $1.5 million) uptake of the M-Akiba bond was mainly dominated by small investors who invested less than KSh 10,000 (approximately $100)”)