The Competition Authority of Kenya (CAK) had its annual symposium in Nairobi last week with sessions on competition, regulation, policy and consumer protection.

On the final day, Director General Wang’ombe Kariuki who is retiring after twelve years had a Q&A talk where he spoke about leading the growth of what was a new institution in government, one which not many Kenyans understood its initial purpose but came to appreciate/enjoy its effects of lower prices. Some of his advice was:

- When you lobby for resources, go with critical evidence and itemized budgets as requests for large sums with no breakdown will not be responded to. So be guided by prioritization and do what you can with what you have.

- Align with international partners and fellow agencies in government and show examples that are relevant e.g. this has worked in Uganda or Tanzania, so let’s do it. But in learning from global peers (OECD, South Africa), adapt stuff for local conditions and do not blindly transplant regulations from developed economies.

- Put your organization in the performance contracts of leaders: (the CAK) was lucky) in that, it was starting up under a new government that appreciated the need to have a strong competition agency as part of the economic recovery strategy (ERS) – so they set out to ensure that as the Treasury implements its ERS, the CAK was a deliverable item in it.

- Identify champions to help you build an agency: In their case, it was the Head of the Civil Service Joseph Kinyua and (then) Finance Minister Uhuru Kenya as champions. They ensure you are fully funded and protect you in Parliament. With the counties, they engaged with the Senate and worked to create champions to address issues like cess which affects farmers, traders and markets.

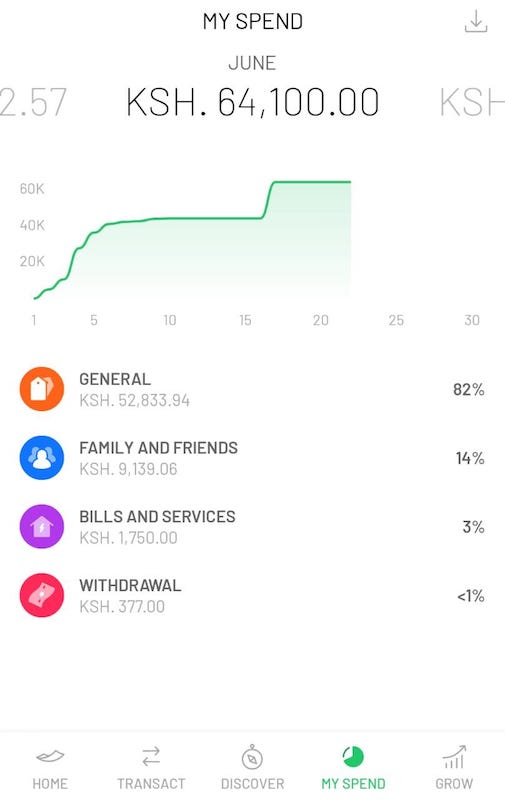

- Understand your industry: they started by profiling what reduces competition i.e is it a behaviour of firms or government regulations? They did 13 market enquiries and prioritized sectors for the government to make interventions; e.g. they updated archaic tea industry laws in which farmers had to get approval to plant or cut tea from one competitor (KTDA) and this resulted in many new tea companies springing up and creating new employment, with higher prices for farmers. Another study of mobile money payments resulted in consumers being able to see charges before they transact, and not after, as was the case before the CAK intervention to create price competition.

- You don’t have to influence the government: It has ears; so do your research that shows advantages to the common man, and the government will listen. Work with the press to highlight studies/work that you have done .. the government may get worried and run with the solutions you have recommended.

- Significant interventions by the CAK over the years include: (i) During covid-19, some supermarkets doubled the prices of sanitizer products but the CAK asked them to refund consumers, (ii) With USSD they brought down the price of phone messages sent from Kshs 10 to 1 during Covid (iii) they also opened up thousands of mobile money agents to serve all telecommunications companies (though whether Safaricom’s competitors took up the opportunity is another story!)