Have you ever seen your credit report? It is often a requirement for job applicants in Kenya to obtain a “clearance certificate” from a credit reference bureau (CRB) as one of the half-dozen source documents to be considered in their vetting.

Kenya has three licensed credit reference bureaus; Credit Reference Bureau Africa (trading as TransUnion), Creditinfo CRB, and Metropol CRB. The initial law on credit reference means that every Kenyan is entitled to get a free credit score every year, but that is not quite the case.

I tried to obtain a report from all of them and here is a review of the three services, in order of ease of access.

3. Metropol Credit Reference Bureau says that you can get your first free credit report by dialing *433# and by paying Kshs 100 via M-Pesa. Prompts indicated that a payment was required and I entered and sent the amount via M-Pesa, but the payment transaction bounced back. Did this twice, and nothing ever came from Metropol and this needs a fix.

2. TransUnion: Credit Reference Bureau Africa was Kenya’s first credit reference bureau and now trades as TransUnion. Registration is Kshs 50/= for you to get your first free credit report. There are two ways of interacting with the service by SMS or by downloading an app.

The SMS route (number 21272) led to a prompt to pay Kshs 50 by M-Pesa. I did that and was led to a mini-menu to choose and receive more text messages. However, each SMS cost Kshs 15 – 19 each to proceed to the next screen and at some point, the TransUnion site advises that it is better to download the app and save on SMS transaction costs.

I did that for the TransUnion Niapshe app from the Google store through which one can request a credit report and a clearance certificate. After payment, it now says you will be getting the free report annually. Also that, as a subscriber, you will get FREE SMS alerts in case of a new enquiry by a lender, new loan information submitted, when a loan goes 60 days into arrears, as well as when a loan is fully repaid.

Since I had already paid the 50, I asked for the report to be emailed. It came behind a password-protected wall for me to enter my national ID (number) to unlock, but that did not work. I emailed a few times back to customer service and got an unlocked report in an email two days later.

TransUnion also sells “clearance certificates” at a cost of Kshs 2,200 (~$22)

1. Creditinfo CRB Kenya. On their site, you enter your name, ID, email, phone number and that leads to a sign-in prompt to pay Kshs 50. Did that, and within five minutes, got my credit report, a four-page PDF with a numeric score, risk classification and the number of credit queries in the past 12 months.

Findings from the Credit Reports

There are similarities in the two reports obtained from CreditInfo and TransUnion including:

- They have some personal information, but the range and detail vary. TransUnion has more tries to add all your known locations and post office addresses. It reads information from your national ID including your home location.

- They have bank borrowing – loans, credit cards, and bank loan apps (in my case Timiza from Barclays and M-Shwari from CBA/Safaricom).

- Both collect information on borrowers such as loans that are performing and non-performing loans, fraud, bounced cheques, credit applications, length of credit history, number of disputed records, court disputes etc.

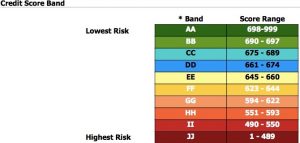

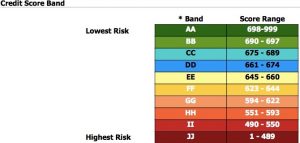

- While CreditInfo gives a score (presumably between 0-1000), TransUnion also does but also gives a band to show what its 0-1000 scores mean. The top band is AA being (700 to 1000), followed by BB (690-697), CC (675 – 689), and a few others up to the bottom (score of 1-489). There is also a star ranking of four kinds; with two dreaded categories of “***Adverse Action Reasons” and “**** Probability Of Default”.

Missing from the reports are:

- Other loan apps – It appears that the many loan apps in Kenya are not subscribers, nor are they sharing their information with the CRB’s.

- They do not appear to have savings and credit society (SACCO) loan data – despite the numerous ads that various SACCO’s have shared about posting loan defaulters to CRB’s.

Lessons for borrowers

- Watch the use of your borrowing; while you won’t have a credit report unless you borrow, borrowing too many times, even if it’s small loans that you repay quickly, may be a red flag. Those emergency loans you take on an app stay on your report for five years after repayment.

- The information posted on different dates can overlap and give conflicting data. But is it in your interest to update the database? E.g. it may have your old employment history or lack your latest address.

- There is an attempt to collect all phone numbers and relations associated with your ID.

- Microfinance institutions and SACCO’s are not benefitting from the credit reference data.

- TransUnion sent an email with some explanations of transaction items – a key to explain e.g. Performing Account with a default history – a loan that you defaulted and later repaid/ you are still paying. Although updated as cleared or closed, the default information will remain in the credit bureau for 5 years from the date of final settlement. Also Non-Performing Account – a loan that you have defaulted (90 days) and is still outstanding. It impacts negatively on your credit score.

Summary

In 2014. banks requested a total of 1.6 million credit reports and that jumped to 6 million in 2015 and then declined to 4.9 million and 4.3 million in subsequent years. Meanwhile, individuals requested 33,000 of their own reports in 2014, 75,000 in 2015, 84,000 in 2016 and 131,000 in 2017. The Central Bank of Kenya attributed this to people seeking credit bureau clearances to contest for Kenya elections in 2017, but it is worrying that banks are requesting fewer new reports as they work to build profiles of existing borrowers.

Accurate credit scoring remains a holy grail in this economy where so many transactions are in the informal sector, and in cash. Credit reference is here to stay, even though many Kenyans don’t understand it or the consequences of not having good credit. Banks have now always been honest brokers, and they have been accused of not sharing information and offering good rates to good borrowers, but only posting defaulters into the credit reference bureau pool. My search proves that this is not the case, but the perception has led to a petition to Parliament to end credit reference bureau practices in Kenya over listing people for owing frivolous balances.

Still, there is no harm in getting your report and knowing what is out there about you.

EDIT: What does your score mean? This article from South Africa is applicable:

The different credit bureaux in SA all have slightly different ways of calculating your credit score, but in general, scores range from around 350 to 999, and what you should be aiming for is a score of 600 or more…at this level, you should not have any problem getting a loan, provided it is within your means to pay the monthly instalments…and the higher your score is above 650, the more likely you are to be able to negotiate interest rate concessions…