- Grumbles still rumbling through Parliament as members realize they have been snookered and the Waiguru motion is dead

- Kenya Revenue Authority (KRA tax collection) target set at Kshs 1.1 trillion for the coming year i.e. ~$12.5 billion

- Financial Services Authority to be established… We should be aware the FSA in the UK had to be split and some of its oversight functions returned to the Bank of England after systemic failures during the global financial crisis. The more apparent implication of establishing the Financial Services Authority is that it would likely see the collapse and merging of…the Capital Markets Authority, the Insurance Regulatory Authority, SASRA (for Saccos), the Retirement Benefits Authority and so on..

- Three new airports to be built in Mandera, Malindi and Suneka (?)

- Duty rates on import of iron and steel products increased from 0% – 25% – apparently to protect local industries

- KRA ordered to stop demanding custom bond from importers of refined industrial sugar and wheat…Those barons lobbied hard

- Import of inputs for seed processing exempted from duty.

- Govt moves to block multinationals from evading tax through transfer pricing where the local subsidiary buys from its mother company at exaggerated prices hence reporting little or no profits. “To keep the relationship at an arms length…” Rotich

- Stock market brokers win big as government and the Investor Compensation Fund forced to retreat and accept only 5% shareholding each in the demutualized stock exchange..Brokers to share 90%.

Category Archives: KRA

Idea Exchange: Bank, Literature, Journalism, Opportunities, and Win a Free Phone

The 2014 Africa Awards for Entrepreneurship will have five awards to celebrate entrepreneurs at different stages of the entrepreneurial life cycle; lifetime achievement, transformational business, outstanding mature business, outstanding growing business and outstanding social entrepreneur.

The Africa Prize for Engineering Innovation. Details here .. via @calestous.

@AfriCOG Investigative Journalism Fellowship Programme 2014. Deadline is 30 May.

Bloomberg Africa @BBGAfrica – seeks Swaziland, Eritrea, Djibouti, G.Bissau, Cape Verde, Eq. Guinea, Sao Tome stringers – Please e-mail asguazzin@bloomberg.net

Citi Africa Management Associate Programme Citi in Africa is looking for ambitious graduates with strong academic backgrounds, maximum of two years’ work experience, leadership, teamwork, and excellent communication skills.

EABL Foundation scholarships for needy students who have gained admission to Kenya public universities. Deadline is June 6.

The Golden Baobab Prizes for Literature include awards for a picture Book (targeting readers aged 6 – 8 years), early chapter (targeting readers aged 9 -11) and rising writers (for a young African author under the age of 18 who demonstrates the talent and drive to become the next great African author for children). Details here and the deadline is June 29.

Jalada / @KwaniTrust seek 3 best Afrofuture submissions for a second anthology. Deadline is D/L 15

Want to be a Jameson brand ambassador? Here’s how to apply (via @uqweli ) oops – deadline also passed.

The Kenya StartUp Cup is open to all Kenyan youth entrepreneurs who can apply to win Kshs 1 million (~$11,500). Details from the @prepaid_africa blog and the deadline is May 20.

KenyaTop100 seeks successful companies with turnover of Kshs 70 million to Kshs 1 billion (~$12,000) with 3 years audited accounts to compete and be among @kenyastop100

Kijabe Forest Trust @KijabeForest is seeking a new logo design.

Kuona Trust has internship opportunities for students at their offices in Hurlingham, Nairobi.

The Kwani Trust 2014 fiction workshop seeks to develop new contemporary fiction writers between the ages of 18 and 24 and from outside of Nairobi. To apply, check the website, and send email to submissions_at_kwani.org by May 26.

Orange has launched the 4th edition of the Orange African Social Venture Prize which will award prizes to four projects; three with grants of 10,000 EUR, 15,000 EUR and 25,000 EUR, and a new special prize of 10,000 EUR. It’s open to all entrepreneurs or legal entities that has been in existence for fewer than three years at the time of the competition and the deadline is 19 September.

School of Data: Become a School of Data Fellow as they are currently broadening their efforts to spread data skills around the world, and are seeking people who are data savvy, understand the role of NGO’s, are interested or experienced in working with journalism and/or civil society, or enjoy community-building. Deadline is 1 June.

Standard Chartered Bank Fast Track Program: The bank is looking for young graduates to join their management trainee program in several African countries, including Kenya, Ghana, Nigeria, Tanzania, Zimbabwe, Uganda, and several international locations. Sourced from @RookieKE blog

The Stanford University Africa MBA Fellowship Program pays for tuition and associated fees (approximately US $145,000) for citizens of African countries with financial need who wish to obtain an MBA at Stanford GSB. Stanford will award up to eight Stanford Africa MBA Fellowships annually. Details here and the deadline is 13 June.

Strathmore University @StrathU scholarships from @imbankke for 10 needy students pursuing various Finance related degree programmes.

Swedish Institute Management Programme The Swedish Institute is launching a new leadership programme for progressive leaders from Kenya,Tanzania, Rwanda, Ethiopia and Zambia – offering a combination of theory and practice in the area of responsible leadership and sustainable business. Details here and the deadline is June 6.

Submit your wikimedia proposals to be included at Wiki Indaba 2014 in Johannesburg. Details here and the deadline is 15 May.

Win a Nokia Lumia 1320: There are very few comments on the blog here despite the number of daily readers, and many of the comments are from spammers promoting products from far off countries. To stimulate comments, I’m giving away a brand new Nokia Lumia 1320 phone (worth about $400/Kshs 35,000) to the person who engages the most on the site. The phone was an excellent, but unexpected, prize awarded to the winner of the best business blog at the recent 2014 Kenya Blog Awards ceremony. During the month of May, readers to the blog and it’s archives, can make as many comments as they want, and I’ll respond on some.

1. There are no rules about winning.

2. It’s about serious comments, not volume – and blog comments only, not tweets/tags

5. An announcement will be made on June 14, and there may not be a winner if no one is deemed to be worthy.

NSSF and SME’s Part II

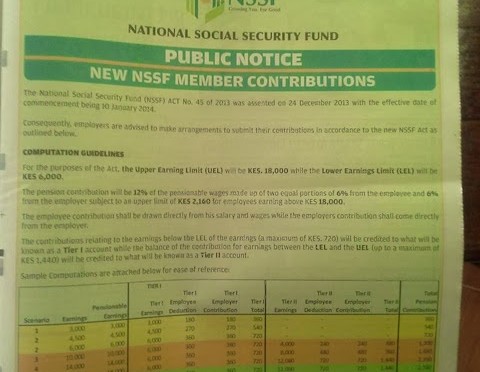

This weekend, the National Social Security Fund ran an advertisement in the newspapers clarifying amounts that employers and employees will pay now that changes to the NSSF act are legal.

Earlier media, and social media, reports had NSSF taking as much as 12% of an employee’s earnings. But the NSSF ad introduced the phrase pensionable salary on which the deduction is based – so it’s a percent of Kshs. 18,000 (pensionable salary) and so if someone earns Kshs. 100,000 ($1,175 per month) and their employer has no current pension scheme, their deductions are:

Tier 1

- Kshs 360 from the employer.

- Kshs 360 from the employee.

Tier 2

- Kshs 720 from the employer.

- Kshs 720 from the employee.

So the total payment for that employee, that an employer will remit to the NSSF is Kshs 2,160 – and not Kshs 12,000. This still amounts to a payment that is five times what a typical company was making to the NSSF last year (Kshs 400 per month, per employee)

From a note at Alexander Forbes Financial Services: The effective date (of the NSSF Act) was 10 January 2014, literally giving employers no time to apply for the opt-out. They thus will have to remit both Tier 1 and Tier 2 contributions to NSSF until the opt-out is granted…also that these amounts will increase each year for the next 5 years.

EDIT – Jan 21: The Government has deferred the commencement of the new NSSF Act to the end of May 2014. This means that the contributions to the fund will be made at the old rate. Read more.

EDIT February 2023:

Statement on the NSSF ACT 45 2013 RULING #NSSFKenya #LeavingNoOneBehind pic.twitter.com/HptEfAaxR4

— NSSF_ke (@NSSF_ke) February 7, 2023

NSSF contributions set to rise from KES 200 to upto KES 2,160 per month https://t.co/ylqdafqDC2 pic.twitter.com/kYjQ2w4MA0

— NTV Kenya (@ntvkenya) February 7, 2023

NSSF New Rates

The NSSF Member Contributions under the NSSF Act No. 45 of 2013 will now be implemented with immediate effect. pic.twitter.com/9XL6u9TF5U— NSSF_ke (@NSSF_ke) February 9, 2023

Kenya SME Options after the 2013 NSSF Bill

The new NSSF Bill enhances the level of mandatory retirement savings to be made by, and on behalf of, an employee. It classifies the contributions made towards retirement savings into various tiers for which each tier has a different treatment. For instance, the first tier must be contributed into the National Social Security Fund (NSSF) while the second tier may be contributed to a private retirement fund if certain requirements are met.

To illustrate, in year 1, the contributions to NSSF will increase from Kshs 400 (Kshs 200 each done by the employer and the employee) to Kshs 720 (Kshs 360 each done by the employer and the employee).

The balance of the 12% of earnings (6% each done by the employer and the employee) may be contributed to a private retirement fund subject to conditions detailed therein.

Thus, there are various options available for an employer seeking a retirement solution. E.g. for an employer with a staff base of 10, setting up one’s own retirement fund may not be prudent due to time and cost considerations. It is instead advisable that they consider joining an already existing retirement fund under an umbrella arrangement or under a personal pension plan. They are further encouraged to use a fund that is registered by both the Retirement Benefits Authority and approved by the Kenya Revenue Authority. A list of umbrella funds and personal pension plans registered by the RBA can be found at their website.

Lastly, Alexander Forbes has a wealth of experience in structuring retirement solutions that are customized to suit the needs of an SME – and that between our umbrella fund (the Alexander Forbes Retirement Fund) and our personal pension plan (the Alexander Forbes Vuna Pension Plan), we can find an exciting solution for SME’s. We are also pleased to meet with companies and talk further through the changes to the NSSF Act and its impact.

Adapted from Angela Okinda of Alexander Forbes

Shares Portfolio February 2013

|

| Kwale Mineral Sands |

Also see Can Kenya Avoid the Resource Curse?