The East African Development Bank (EADB) is a development finance institution, headquartered in Kampala, Uganda and has country offices in Kenya, Tanzania and Rwanda. It was one of the few institutions that survived the collapse of the original East African community. Its main products are medium-term financing and its long-term loans for projects that can be durations of 12 years.

The bank is in the news over a case involving Kenya’s Cabinet Secretary Raphael Tuju over their demand that he repays $13.6 million (~Kshs 1.4 billion) that arose from a $9.19 million loan in April 2015.

Excerpts from the 2019 EADB annual report:

- The bank is owned by four East African countries; the Governments of Kenya 27%, Uganda 27%, Tanzania 23% and Rwanda 9.5%. Other shareholders are the African Development Bank with 8.8% and FMO Netherlands with 2.7%.

- EADB has $374 million in assets, which includes $190M in cash in the banks. It earned a profit of $8.7 million (~Kshs 944 million). It is exempt from taxes in all members countries but pays no dividend as their policy is to build up capital of the bank.

- Had $152 million (~Kshs 16.5 billion) of loans of which $58M (38%) are to Tanzania ventures, $39M to Uganda, $36M to Kenya ones and $17M to Rwanda borrowers. $109 million (71%) of the loans are in US dollars which is the preferred currency of most borrowers.

- Of the loans, $92M are in stage one (performing normally), $52M in stage two (higher credit risk) and $7M are in stage 3 (impaired).

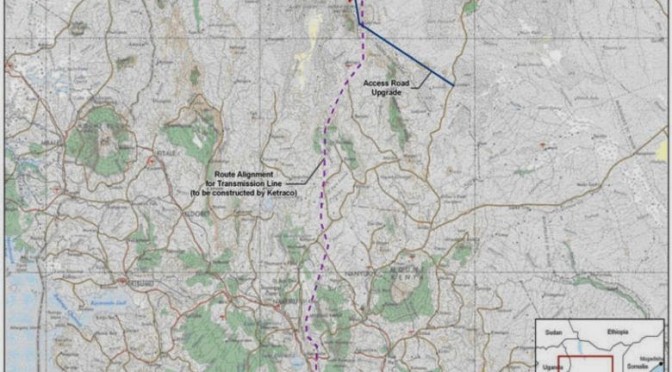

- During the year, existing clients – Kayonza Tea Growers, Centenary Rural Development Bank, Opportunity Bank, and the Government of Tanzania all increased their borrowing. Also in 2019, some long term loans paid off and exited the bank including Nkumba University, Sugar Corporation of Uganda and New Forest Company. The bank also participated in the official launch of the Lake Turkana Wind Power which they partially-financed while Strathmore University completed a Law School Centre for which EADB has provided a Kshs 422M loan.

- The bank disbursed $21.3 million to new projects during the year. Some were: in Tanzania (National Housing Corporation, $30M to Iyumbu Satellite Centre, and to Tanzania Petroleum Development Corporation to distribute natural gas to 30,000 households), in Uganda ($6.3M for a medical consumables manufacturing plant in Kampala), in Rwanda ($10M to a new cement plant and four lines of credit to a national development bank) and in Kenya (Kshs 30M working capital to Jumuia Hospitals in Huruma), Sidian Bank (EUR 2 million credit line) and Musoni Microfinance (EUR 1 million credit line).

- They have borrowed $81 million from multilateral development banks and other financial institutions including the European Investment Bank, African Development Bank ($22M), CBA ($9M), the Arab Bank for Economic Development in Africa ($10M) and a new line from KFW Germany ($7.8M) whose recipients include Sidian Bank, Musoni Diary and West Kenya Sugar.

- Kenya’s Treasury Principal Secretary, Dr. Julius Muia sits on the board while Treasury Cabinet Secretary, Amb. Ukur Yattani sits on the Governing Council along with other East African finance ministers.

Older notes on how EADB is different from a typical commercial bank:

- EADB disburses payments to third parties e.g. supplier or contractors for work done/services rendered to sponsor. Disbursements are made against presented supplier invoice or completion certificate for building works. They insist that sponsors procure through open tendering as much as possible.

- Most EADB loans are repaid quarterly except leases which are monthly. Projects are required to set up standing orders for loan repayment.

- They don’t have a deposit-taking, commercial bank so borrowers make repayments to special accounts at other banks (escrow accounts) e.g. payments from buyers of apartments financed by EADB are made into such accounts.

- Companies are required to submit quarterly accounts for monitoring and failure to submit accounts can delay further disbursement to a project.

- EADB lending approval decisions are made based on the loan amount involved and applications that are larger than $1 million are approved by the board of directors.

- As a DFI, some criteria for the financing of projects include economic measures such as increasing the level of real consumption, contribution to government revenue (corporate tax, VAT, excise, export taxes), foreign exchange saved, and employment opportunities created.

- Projects in arrears get transferred to their “Work Out Unit,” a special department that determines how to resolve these – either by a recovery (sale of assets), write-off (after selling assets), or a turnaround (reviving projects to normal) which is the preferred and most successful option. Sometimes, the borrower is asked to recommend a buyer of assets (provide leadership) if it becomes necessary to sell some of them.

- The bank enjoys immunity from prosecution and this has been raised by Tuju’s lawyers in several pleadings. In the past, EADB has also faced challenges including petitions to wind it up, such as a decade ago when they trying to recover over $13M from Blueline, a Tanzanian transporter.

- edit On September 28, the OPEC Fund for International Development signed a $20 million loan in favour of the East African Development Bank to go towards supporting SMEs and infrastructure projects in East Africa, in the third loan of this kind that the OPEC Fund has provided to EADB.