Standard Bank (Stanbic) Group Kenya released their Macroeconomic update in which they are cautiously optimistic about Kenya’s growth through the private sector. The presentation in Nairobi was done by Jibran Qureishi, the Regional Economist – Africa at Stanbic.

Highlights:

- Stanbic economists believe that global growth will fall in 2020 and 2021 as central banks in advanced economies are tapped out and their ability to stimulate economies is limited. Chinese growth will slow to sub 6% in 2020 and be about 5.5% in 2021. Meanwhile, the US cut its rates three times last year but investments are still falling as the trade war with China has hurt growth.

- For Kenya, Stanbic expects 5.9% GDP growth in 2020, up from 5.6% in 2019. Three things that held back private sector over the last two years were interest rate caps, delayed payments by government and congestion at the Inland Container Depot (ICD) Nairobi.

- Government policies should focus on private-sector driven economic growth.

There is growth but where are jobs? Growth in the wrong place. 90% of new jobs are the informal sector and also in the service sector but these will not create a middle-income economy. - Tourism was resilient, earning $1.5 billion last year, but the potential is much larger and this depends on how much private investment the sector can attract. Kenya gets 2 million arrivals but Mauritius, Morocco, Egypt and South Africa get about 10 million in bad years.

- Ambitious tax revenue targets embolden the government to spend more and tax revenue targets are still much larger than average collections.

- If the government does not fix fiscal issues, this will lead to unpredictable tax rules which could hamper productive sectors

- A move back to concessionary loans and away from commercial loans for the first time since the (President) Kibaki years is a welcome step.

- The Standard Gauge Railway (SGR) may still get extended to Uganda but the government will have to build new ICD. It is not that China does not have money, but they are asking questions they should have asked 7-8 years ago.

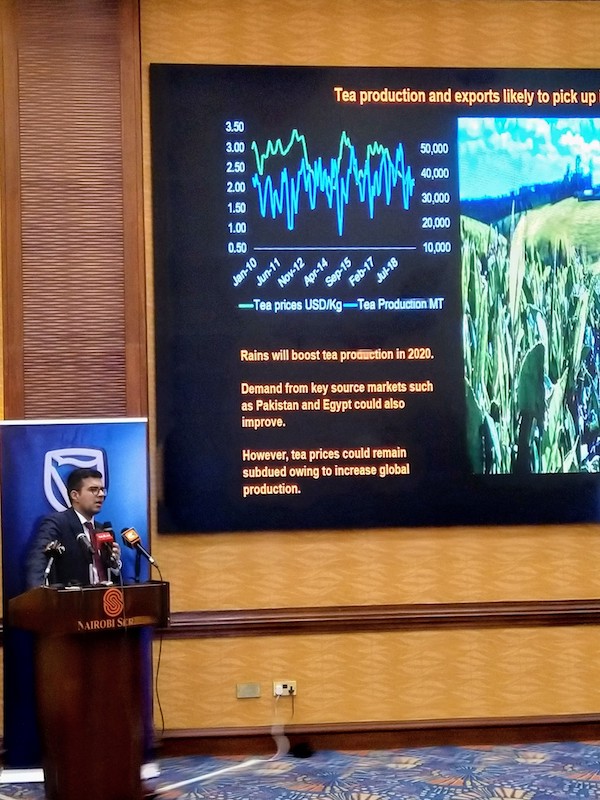

- Kenya traditional manufacturing has been an import-substitution model which has not really worked around the world. Better to shift from being protectionist and instead work towards growing exports which (excluding tea and remittances) have been stagnant – at $6 billion a year

- Don’t focus on manufacturing too much and neglect agriculture, as a big part of that will come from agro-processing and adding value to agricultural produce.

Charles Mudiwa the CEO of Stanbic Kenya spoke of how the bank has aligned to the government’s agenda. They are a shareholder in the Kenya Mortgage Refinance Company, and 20% of their lending goes to manufacturing with another 9% going to agriculture & food security.

Stanbic was the lead arranger for the Acorn green bond that was listed on London’s LSE today. The bank also has a DADA program to promote women financially (with a goal to lend Kshs 20 billion) and is also supporting financial literacy training to musicians and Uber drivers.