- The NSE borrowed Kshs 300 million from Kenya Commercial Bank to part finance the purchase of the Westlands building that now houses the exchange. (The interest rate is minus 2 the bank’s base rate). Part of the funds raised from the IPO will be used to repay the Exchange’s mortgage debt.

- The Dar es Salaam Securities Exchange has completely divested from the NSE and CDSC.

- The NSE has about Kshs 1 billion assets and an EPS of 10.70. They had earnings of 622 million and a profit of Kshs 262 million in 2013. The NSE owns Kshs 20 million worth of Safaricom bonds and Kshs 15 million of Housing Finance ones

- The IPO is budgeted to cost Kshs 40.8M

- Ahead of the IPO in which 194 million (M) shares are being listed, the Kenya Government and the Investor Compensation Fund each own 6.56 million shares and 22 stockbrokers each own 4.08M shares – for a total of 128.6M shares. 2.5 million shares are reserved for employees of the exchange (The NSE has 38 employees and 5 senior managers).

- KRA assessed and charged them Kshs 19m for 4 years of back taxes, of which Kshs 15m has been paid

- One of the options the Exchange is contemplating is to establish regional exchanges in Somalia, the Democratic Republic of Congo (DRC), South Sudan and Burundi

- The NSE expects to introduce the REITs and ETFs, and there are also plans to introduce the a Derivatives Market this year. The NSE also plans to upgrade of the Automated Trading System (ATS) and the Bonds Trade Reporting System with some of the proceeds from the IPO.

Monthly Archives: July 2014

YALI 2014

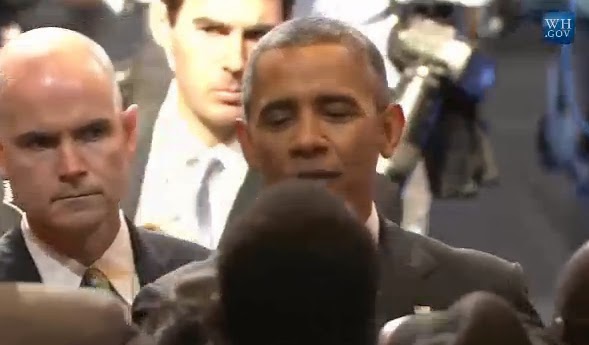

The Young African Leaders Initiative 2014 – #YALI2014 kicked off this week in Washington DC. Speaking at a meeting with 500 of the first class of YALI fellows, President Obama said that it will be renamed the Mandela Washington Fellowship (& doubled to have 1,000 fellows by 2016) and that four regional leadership centers would set up in Africa.

The regional leadership centers will be established in Senegal, Ghana, South Africa and Kenya and will offer courses on leadership, support for entrepreneurs through mentoring and access to capital and a networking forum.

The Center in Kenya will have a robust training curriculum with direction from a partnership that brings together Deloitte’s global management and strategy skills, the established curriculum and capacity of Kenyatta University, the public administration training of the Kenya School of Government, and Africa Nazarene University’s youth engagement and outreach.

USAID is investing $38 million in the new YALI centers with support from the MasterCard Foundation ($10 million), Microsoft ($12.5 million), Intel ($5million) and Dow Chemical ($4 million). Others are McKinsey, IBM, General Electric, Procter & Gamble and the Mara Foundation. (More at the YALI site).

In a Q&A session, Obama also spoke about AGOA and the on-going for renewal of the trade partnership between the US & Africa; He said, they have learnt lessons from the previous phase of the partnership and will work to lower other export barriers (such as transport & trade finance), and, starting with Uganda, Kenya and Tanzania, take steps to see how AGOA can work with effective trading bloc for intra-Africa trade.

The YALI Summit events will lead up to the first US-Africa Leaders Summit, which, with over 50 presidents & prime ministers expected, is the largest gathering of African Leaders ever hosted by a US president.

Kenya’s President Kenyatta is to participate in two events next week – a doing business in East Africa session and a presidential dinner, both organized by the Corporate Council on Africa (CCA) who have events for several other African leaders and nations like Ethiopia, South Africa, Ghana Liberia Congo Mozambique and Tanzania among others.

New Credit Cards from NIC and Equity banks

This week, NIC Bank launched a platinum credit card and Equity Bank formally announced their expanded impressive card portfolio that now includes American Express.

The NIC Bank Visa Platinum credit will be offered to a select few clients like professionals, senior government employees, business leaders, and entrepreneurs. The card comes with a variety of privileges in terms of shopping discounts, priority pass access to 600 VIP airport lounges in 100 countries (with complimentary snacks, free internet at many, and cardholders can bring in companions), a portfolio relationship manager, and purchase protection for 90 days.

For frequent travelers around the world, it also provides useful facilitation in emergencies like payment of hospital deposits of up to $2500 and arranges for emergency evacuation, legal advice, transport of companions or children.The annual fee is Kshs 6,000 (~$70) and there is no joining fee. NIC will also have a rights issue and a bond issue that shareholders will kick-off next week at an EGM.

Equity Bank is signing up merchants to accept American Express cards – for which they are the exclusive card issuer in Kenya. They have already signed on Nakumatt, ArtCaffé, Heritage Hotels, Best Western, Laico Regency, Leopard Beach, Boma and some other hotels.

Speaking when he confirmed the development, Equity Bank Managing Director, James Mwangi, said “the bank is now a partner for American Express, Visa, MasterCard, PayPal, Google, China Union Pay, SWIFT, JCB, VFX (Equity Direct) and Diners Club.” As per Central Bank stats, Kenya had about 162,000 locally issued credit cards as at February 2014, compared to 114,000, three years ago.

Lady Lori & FastJet?

FastJet, as a low cost operator has made the A320 the only airline in it’s fleet and one that made a few people wondered how Fly540 with a mix of ATRs and Bombardiers would integrate. Lady Lori offers a fresh start in this regard.

Fin4Ag14

All this week, Nairobi plays host to a conference called Fin4Aag14 which has the theme of Revolutionising Finance for Agri-Value Chains.

It started with plug & play session in which 18 companies got to introduce their platforms linking agriculture to finance across Africa. This is the second edition of the session that was introduced at the conference in Kigali last year and proved to be quite popular.

The 18 companies were:

- Tangaza Pesa: automates the value chain by doing KYC on farmers with bio data, crops produced, and GPS to build credit records

- Ensibuuko (Uganda) helps (via web & mobile) to manage rural SACCO’s that can reach many of the rural unbanked farmers

- FarmDrive (University of Nairobi) enables small farmers to keep basic record by mobile phone and build a credit score

- Farmers Record Management System (FARMIS) aggregates farmers with financial institutions to access finance and ensure loans are properly utilized

- Zoona’s eVoucher platform: enables agri-business supply chain payments and insurance

- Credit Information Sharing: enables information sharing by credit bureaus for lenders to make decisions

- Umati Capital: paperless solution that aims to shorten dairy farmer payment periods from 6 weeks to 24 hours

- Agrilife – enables farmers to access markets inputs, savings, and asset finance

- Musoni System: a core banking for SACCO’s and micro-banks, loans, and savings that can also integrate with m-pesa and tablet apps

- Farmforce (Sygenta) enables traceability of farm produce for quality and for farmers to access small loans

- e-Krishok: Online & mobile infer for Bangladesh farmers to access information, traders and finance

- Creditinfo’s Credit Bureau Solution – enables credit bureaus can collect info on farmers so they can access loans without the need for collateral

- Craft Silicon have a platform that can link to MFI’s, bank, SACCO’s (Elma?)

- aWhere Platform: with over 1 billion data points collected, enable farmers to be aware of field risks to make smarter decisions. this includes weather data for all of Africa since 1999 and others they pull from mobile services

- AgroCentral – uses ICT to buy produce from farmers

- RiMFin (Ghana): enables rural farmers to receive mobile payments and save them in their phones

- finFinancials (Fintech) core banking platform that can integrate with others for digital or mobile payments

They will be there all week presenting their platforms and engaging the attendees who are from across Africa, Caribbean and Asia and who include development specialists, financiers, policymakers and top bankers who hope to get youth interested in agriculture.

There was a brief session on warehousing that detailed both the challenges and the opportunities for warehousing. Commodity warehousing types include private, public and community. Examples were cited from Tanzania (community food stored in individual houses but linked to MFI’s ), Ivory Coast (large presence in Cocoa Rubber Cashew sectors), Madagascar (communities totaling 80,000 rice farmers in villages part guaranteed by DFI’s cover 2% of the national production but provide price stability), and Nigeria (massive 1.3 million ton silo capacity against large formal sector demand of 1.9M tons), Burkina Faso and Uganda (2 successful warehouse companies).

Challenges facing warehousing include high costs (leaving some empty of commodities) fraud, long value chains, and contract defaults (by both small farmers and larger organizations like WFP).

Fin4Ag14 is organized by the Technical Center for Agricultural and Rural Cooperation (CTA), Central Bank of Kenya and African Rural and the Agricultural Credit Association (AFRACA), and is supported by the FAO, the Rockefeller Foundation and Afreximbank.